Payment for motor third party insurance is now on your fingertips

Annet Nantongo

We have all either seen or fallen prey to some of these occurrences.

You see a traffic police blockade, you remember your Motor Third Party (MTP) insurance expired and is up for renewal.

You decide to drive on the side of the road while closely hiding behind the car in front of you.

For every metre driven, closing the distance between you and the traffic officers, you silently beseech God to grant you divine favour and make you invisible so that the traffic officer doesn’t stop you for any checks.

Lo and behold he stops you, you are left either with beads of sweat drenching your backside or taking the risk of running away, as you smile and wave to feign rapport with the officers.

Whichever way you choose, you make a divine promise to pass by the next agent and sort your MTP cover.

Not anymore. The hustle and mad dash to pay for your motor third party will be history.

The struggle of looking for an insurance agent will be no more with the availability of payment for Motor 3rd Party on your mobile phone.

The Insurance Regulatory Authority (IRA), Uganda Revenue Authority (URA), Ministry of Works and Transport, and telecom companies have created a platform to streamline the operations of Motor Third Party Insurance in Uganda.

You can pay with either the MTN menu, Airtel menu or Centenary Bank Agency Banking.

MTN subscribers will dial *165# and select 4 (payments), select 5 for fees and taxes and then select 5 (motor third party, enter vehicle details, and complete payment.

Whereas Airtel subscribers will dial *185#, Financial services- 7, Insurance – 3, Motor third party – 1, enter vehicle details, then complete payment, those using the Cente Agency Banking, the agent will guide and use prompts to fill in the details in order to complete your payment.

It is key to note that you can only subscribe to this new service if your car is on the URA eTax database, otherwise, a taxpayer is unable to utilise this if they still subscribe to the old vehicle management system.

All hope is not lost because you can easily upgrade your car to the eTax database. When you visit the URA web portal (https://ura.go.ug), under the Guides section, clicking on the How to use e-Services, leads you to Motor Vehicle, then to How to validate your motor vehicle.

The guide gives step-by-step instructions on how to log into your account on the portal and validate one’s car onto the e-Tax database.

Automobile owners have a grace period till June 2020 to validate their vehicles or motorbikes onto the database in order to utilise this service.

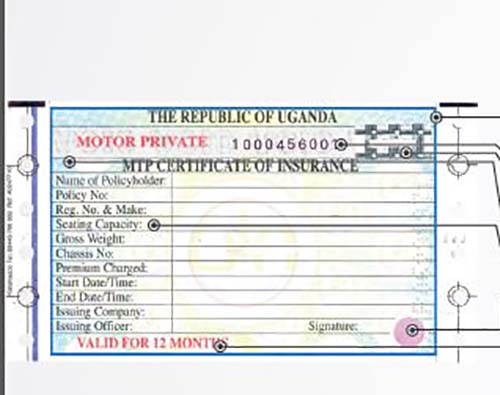

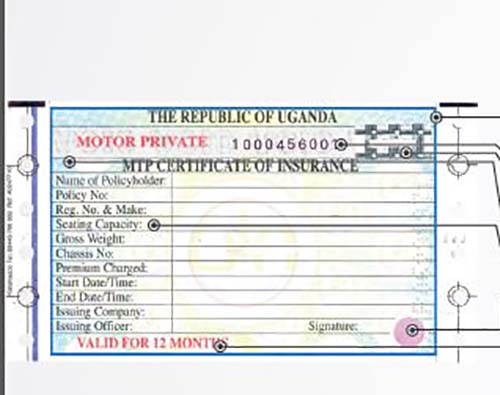

This platform is working through a live interface with the Insurance Regulatory Authority (IRA) system. When payment is complete, a message is sent with your insurance sticker number.

You then walk to any insurance firm of your choice to print the sticker with the given number.

The next time a police officer stops you with expired MTP insurance cover, you won’t have to fumble around for niceties to help you escape a penalty.

You can just park on the side (hoping that the mobile money accounts have float), punch in the transaction prompts, make payments and generate an authentic Insurance sticker number.

Common practice today in MTP renewal requires moving to any Insurance outlet (agent/company) and present your log book, an agent computes your MTP premium.

You then make a payment (usually cash) and receive a Motor Third Party sticker, and finally display the sticker in a conspicuous position in your car and off you go.

From IRA, there is inherently nothing wrong with how people are currently consuming MTP.

The industry is however laced with unscrupulous people who use illegal means to issue forged MTP stickers to the unsuspecting public.

There are several cases of loss of stickers and other related documents making it hard for potential claimants to approach the insurance companies when they don’t have such documents.

This interface brings with it several pros such as a verification USSD code that will be used by the police or vehicle inspectors to ascertain insurance sticker authenticity.

The centralization of the payments for the service will cut out such criminality and correct the reputation of the insurance Industry.

In addition, this platform will grow the levels of tax compliance from insurance companies because the stamp duty from MTP will be remitted instantly to the revenue body.

The URA eTax database has a register of over 1.1 million automobiles on the road, plus an additional 500,000 pending approval, that are supposed to pay for MTP.

However, IRA says about 400,000 of the MTP stickers on the road currently are authentic. Meaning that there is a gap of over 700,000 automobiles operating with probably forged or no MTP stickers.

These motorists risk solely shouldering accident injury or death costs. You might secretly think you can run away from the accident scene.

However, your days could be numbered that in a very nasty accident, you may be unable to run away from the wreckage.

Therefore, verify your MTP certificate to ensure validity and if you haven’t paid, purpose to close that gap so that you avoid the pain and embarrassment of not paying that seemingly small but useful cover, in case of an accident.

This initiative is one of the many ways URA endeavours to bring services closer to the taxpayer and encourage self-service, the Do-it-yourself culture.

This is a great step towards increased use of technology in tax administration that enhances service effectiveness while limiting tedious processes.

The world has digitally evolved all around us and we are keeping up with the trends.

The writer works with the Public and Corporate Affairs Division of Uganda Revenue Authority.

The post Payment for motor third party insurance is now on your fingertips appeared first on Nile Post.

0 Response to "Payment for motor third party insurance is now on your fingertips"

Post a Comment